👋Introduction

One of the common issues that we experience at our AAT approved exam venue in Sunderland and Hull is our external students at other training providers who are unsure of the qualification that they are studying. This usually involves confusion over the AAT Certificate in Bookkeeping and the AAT Certificate in Accounting (for AAT Level 2) or the AAT Certificate in Bookkeeping and the AAT Diploma in Accounting (for AAT Level 3).

This usually relates to a lack of clarity regarding studying a bookkeeping or accounting qualification at AAT Level 2 or AAT Level 3. In this post, we’ll explain the key differences between AAT bookkeeping and accounting pathways at Level 2 and Level 3. We will show you exactly what is included in each course, including the name of the units. This will help you feel more prepared and confident when booking an exam with us.

🤔AAT L2: Certificate in Bookkeeping vs Certificate in Accounting

The AAT L2 Certificate in Bookkeeping consists of only two exams:

- Introduction to Bookkeeping (ITBK)

- Principles of Bookkeeping Controls (POBC)

The focus in this qualification is towards double-entry bookkeeping principles. It is ideal for students looking to gain a basic understanding of bookkeeping or if they want to ‘test the water’ before continuing to pursuer a career in accounting or finance.

The AAT L2 Certificate in Accounting consists of four exams:

- Introduction to Bookkeeping (ITBK)

- Principles of Bookkeeping Controls (POBC)

- Principles of Costing (PCTN)

- The Business Environment (BENV)

This is a broader qualification as it includes the two bookkeeping units mentioned in the L2 Certificate in Bookkeeping, but there is also two additional exams in basic management accounting and understanding the business environment in relation to accountancy and finance. This qualification is better suited to learners who are aiming to broaden their accounting and finance knowledge. It allows for a greater range of options in the future. For example, studying AAT accounting qualifications at Level 3, Level 4 and beyond. It may also be more suited to learners who want to keep their career options open; potentially going into other areas such as management accounting and business/finance advice in the future.

📌Why It Matters at the Exam Centre?

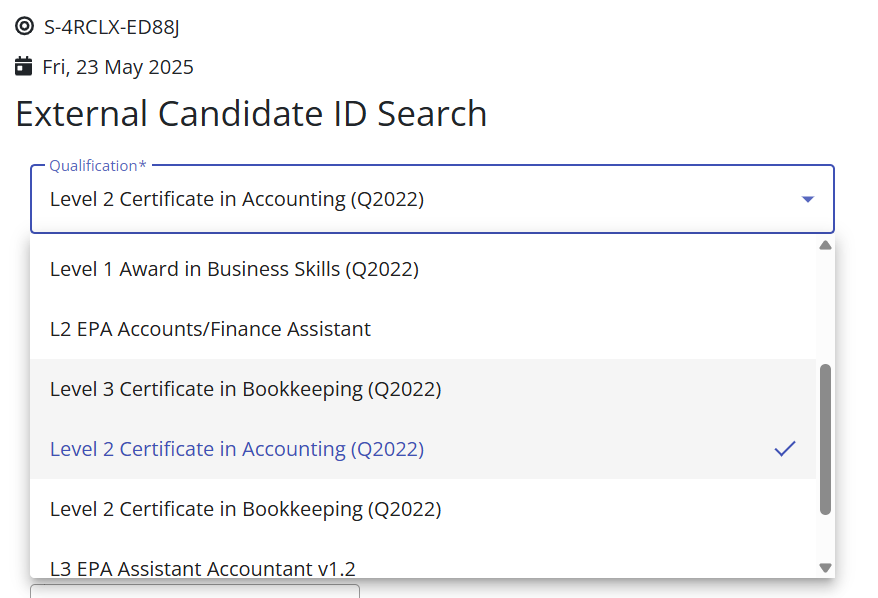

If you are sitting an AAT exam at our exam centre in Hull or Sunderland, it’s important that we know which exam will need to be scheduled. As you can see from the screenshot below, when scheduling an exam, both the AAT L2 Certificate in Bookkeeping and the AAT L2 Certificate in Accounting appear on the list for scheduling exams. It is therefore important that you know the correct qualification that you are studying

AAT L3: Certificate in Bookkeeping vs AAT L3 Diploma in Accounting

Similarly to the L2 Certificate in Bookkeeping and the L3 Certificate in Accounting, we also have a similar scenario in the AAT Level 3 qualifications.

The AAT L3 Certificate in Bookkeeping consists of only two exams:

- Financial Accounting: Preparing Financial Statements (FAPS)

- Tax Processes for Businesses (TPFB)

This qualification is essentially a progression from the AAT L2 Certificate in Bookkeeping that we described above. It’s a great progression route from this bookkeeping certificate and it is suitable for any learner wanting to develop their knowledge at this advanced level. In addition to this, another fantastic benefit of completing this qualification is that it will allow you to apply to become a licensed bookkeeper. This is known as AAT Qualified Bookkeeper (AATQB) status and on completion of the L3 Certificate in Bookkeeping, you will be able to apply for this status. Further information about the AATQB process can be found on the AAT website.

The AAT L3 Diploma in Accounting consists of four exams:

- Financial Accounting: Preparing Financial Statements (FAPS)

- Tax Processes for Businesses (TPFB)

- Management Accounting Techniques (MATS)

- Business Awareness (BUAW)

This is an advanced level diploma and is a good progression route if you have previously completed the AAT L2 Certificate in Accounting that we mentioned earlier in the article. The topics studied at this level are a development from the four units studied in the AAT L2 Certificate in Accounting and they will continue to develop your knowledge of those units completed previously. The L3 Diploma in Accounting can also help you to progress into future qualifications – in particular, the AAT L4 Diploma in Professional Accounting is a fantastic progression route when you complete the AAT L3 Diploma in Accounting.

❓Can I Progress from the AAT Level 2 Certificate in Bookkeeping to the Level 3 Diploma in Accounting?

Yes – absolutely! In fact, this has been quite a popular route for our current and previous students at Accountancy Tuition Academy. It would mean that the L2 units that we not previously completed (Principles of Costing and The Business Environment) may need some additional training before commencing the L3 equivalent units (Management Accounting Techniques and Business Awareness). This is a feasible option when studying with us – we have experienced tutors who have guided many students in completing the transition from a bookkeeping certificate at L2 and then progressing into the AAT L3 Diploma in Accounting.

🗂️Visual Guide – AAT Qualifications Comparison Table

| Level | Qualification Name | Focus Area | Units Covered | No. of Exams |

|---|---|---|---|---|

| Level 2 | Certificate in Bookkeeping | Bookkeeping fundamentals | Introduction to Bookkeeping Principles of Bookkeeping Controls | 2 |

| Level 2 | Certificate in Accounting | Bookkeeping and wider accounting/finance topics | Introduction to Bookkeeping Principles of Bookkeeping Controls Principles of Costing The Business Environment | 4 |

| Level 3 | Certificate in Bookkeeping | Advanced bookkeeping only | Financial Accounting: Preparing Financial Statements Tax Processes for Businesses | 2 |

| Level 3 | Diploma in Accounting | Full range of accounting topics | Financial Accounting: Preparing Financial Statements Management Accounting Techniques Business Awareness Tax Processes for Businesses | 4 |

✅Checklist: Know Before You Book Your AAT Exam

- What’s your qualification title?

- What is the name of the exam you’re booking?

- How many exams are in your qualification?

- Are you sitting the next exam in your sequence?

- Have you confirmed the exam with your training provider?

📞Still Unsure? We’re Here to Help 📧

If you’re sitting exams at our AAT approved exam centre in Sunderland or Hull and you are unsure of what to book, contact our admin team ahead of time. Knowing your qualification and unit names means a smoother, stress-free exam experience.

Finally, if you are also considering your options as a student and you still want to discuss the differences between the bookkeeping and accounting qualifications prior to enrolling with Accountancy Tuition Academy, please contact Alex Meredith using one of the options below:

Tap to Call Email